Testimonials

[testimonial author]

Rated 5.0 on Quickbooks ProAdvistor

800+ Likes on Facebook

Intended to simplify the current arrangement, the Government’s planned changes include taxing unincorporated businesses on the profits made in a tax year and moving the year-end of those businesses to align with the tax year.

The change is set to happen in the 2024/25 tax year, this will be the first year we move to the ‘Tax Year Basis’

This change will only affect self-employed individuals, partners, trusts, and estates with trading income. It will not affect companies.

Before the changes were announced, basis periods were used in the early years of a new business and when a business closed. Basis periods are used to allocate profits to specific tax years, the rules surrounding them are complex and mostly handled by your accountant.

They would also have been used when a trader requested to change their year-end date.

When operating basis period rules, often profits are taxed twice, in these instances, the doubly taxed profits are known as ‘overlap profits’. A trader carries these profits forward and they provide relief when a business ceases trading or there is a change to the year-end date.

The majority of unincorporated businesses already have a year end date of 5 April or 31 March, the new rules will have no effect on these traders. For some, however, seasonality of trade or other operational issues mean their year-end is at a different time.

For the 2024/25 tax year, the profits you will be assessable on will run from your normal year start date to 5 April 2025, regardless of your usual year end date.

For the businesses the change effects, the accounting period will be more than 12 months and there will be overlap profits created. If the business has overlap profits carried forward, we can use these to reduce the assessable profits.

A business which draws up accounts to 30 June every year would normally have a tax liability for 2024/25 based on the accounting year ending 30 June 2024.

As this is the transitional year for these reforms, the actual taxable period would be 1 July 2023 to 31 March 2025, a 21-month period.

HMRC argue that such a business would have 9 months of overlap relief to use from the early periods of trading, and hence only 12 months are really being taxed in that year. However, in many cases the 9 month overlap profits for the start of a trade will likely be far less than the 9 months profits of an established business.

No, the change is not compulsory, and your business can remain trading to a different year end date.

However, this will mean added work for your account as regardless of your accounts year-end date, your self-assessment tax liability will be calculated on the assessable profits of the tax-year. This will require apportioning profits across multiple accounting periods.

Obviously, the decision will be yours and must be based on your own individual circumstances.

There is no denying this is going to have an impact, with cashflow being the hardest hit. As we know for small businesses cashflow is imperative for success. So, my advice is to start planning now for the impact on your business.

Start your cash flow forecasting

Start saving for the extra tax liability

Look at your VAT quarters and perhaps consider changing these if they will fall at the same time the tax is due.

As the saying goes “fail to prepare, prepare to fail” – planning for this change is going to be so important for you.

If you would like to discuss these changes further and how it is going to impact on you and your business, please get in touch.

In this edition we meet Jane Depledge course leader and founder of Soul Companions, a provider of End of Life Care Doula training courses. Soul Companions aim is to engage people with learning that enables them to encourage others to consider, talk about and plan death as it is a scary and lonely event.

Hi Jane! Could you tell us a little bit more about Soul Companions and what you offer your clients?

Soul Companions offers training for people wishing to give services to others who are known to be palliative and reaching the end of their life. Whilst it facilitates education and training it ultimately offers care in people’s own homes and support for families. We are known as End of Life Doulas. As a Doula myself I can also provide support to my own community. As doulas, we feel this is most important as the majority of people wish to die in their own homes. Death should not be feared; it is the unknown, not knowing what to do, being alone that causes people to be anxious. Our training disperses this and translates into practice to allow people to die with dignity, respectfully and peacefully. This stays with families and helps them with their own grief.

In three words, describe your life as a business owner?

Rewarding. Fulfilling. Controllable.

As a business owner, what has been your biggest success and what have you found most challenging?

Switching my classroom learning to Zoom because of Covid was a challenge but this has also been my biggest success.

What advice would you give other entrepreneurs who are starting out?

Believe in yourself. Don’t lose sight of your vision but be prepared to adapt. Be patient. Better to build on a solid foundation than crash and burn.

How did you start working with KC Accountancy Services, was there a reason they stood out from other accountants?

Yes, Kim came highly recommended. When I met her we gelled. She has a warm open and honest nature and I knew I could trust her not just with this business but with my portfolio of work. All too complicated for me!

Why do you think it is important to work with an accountant, how has your relationship with KC Accountancy Services benefited your business?

I’m an expert in nursing not accounting and I detest filling in forms. KC Accountancy Services keeps all my accounts which is a relief to me. An accountant means my tax returns are on time, hassle-free and accurate, so I benefit knowing I am paying only what I am required to pay.

What are your future plans for Soul Companions?

To offer training to councils, agencies and promote Doula care in the community.

Thank you Jane!

For more information on Soul Companions and the services they offer visit:

www.soulcompanions.co.uk

A few words from Kim…

“Jane and I started working together in 2019, Jane had moved to the area and was doing long commutes to work as a nurse. Jane was looking for an accountant she could trust and connected with, I remember during the initial consultation being so interested in Jane’s businesses and blown away by her passion for helping people. I had never met a doula before and certainly not someone who focused on end-of-life care, it is humbling to speak with Jane and hear the compassion she shares with families but also her unwavering professionalism and gentle nature when supporting families and passing her skills and knowledge to doulas-in-training through her courses.

Jane came to us and was looking for support with her limited company, sole trader business and general advice and tax planning requirements to ensure her employment income along with the income from her businesses were working in the most tax efficient way possible for her. I really enjoy being in a position where I feel like I am taking away the stress and pressure of paperwork and compliance for our clients, so they can plough all their energy into their own businesses and personal growth.

Corona-virus and national lockdowns came in to force very early into our working relationship, this did not affect how I worked with Jane, and I did all I could to ensure she was aware of any help and assistance available to her. I was very impressed at how Jane diversified her business and quickly found a way to continue operating at a reduced level. We supported as best we could and offered guidance and assistance where required.

I meet with Jane at least once a year to go through her accounts and we discuss the future for her and her plans, this is such an important element of the way we work. Allowing us access to your future business hopes and goals, means we can work effectively to put plans in place and support you to realise them as quickly as possible. It’s also a great opportunity for a coffee and catch up, which I love doing with all clients.

I look forward to continuing working with Jane, her passion for what she does is inspirational, and I wish her continued success with all her hopes and goals!”

If you would like more information about our services, or if you are a current client and would like to be featured in a future edition of Client Focus, then please don’t hesitate to get in touch with our team:

info@kcaccountancyservices.co.uk

Tel: 01691 674792

To view the full interview in PDF, please click here.

This edition meet Matt Saxon owner of Saxon Clean, a family run window cleaning business based in Llanfyllin, Wales. Established in 2000, Saxon Clean always pride themselves on providing a high-quality window cleaning service in a timely and stress-free manner.

Matt discusses some of his successes and challenges that comes with his role as a business owner and how moving to KC Accountancy Services in 2018 has enabled him to concentrate on the business side he enjoys and not think about the other stresses that come with running a business.

Hey Matt! As a business owner, what is it that motivates and drives you?

I enjoy pushing things forward and keeping all our customers as happy as we can. Always thinking of new ideas and how we can run things more efficiently giving the customers the best service we can.

If you had to describe your life as a business owner in three words, what would they be?

Hard, busy and rewarding.

What has been your biggest success and what have you found most challenging?

I am very proud of what we have achieved over the years and it couldn’t have happened without my amazing staff. Without them it wouldn’t happen so that I am very grateful for. One of the biggest challenges was finding them! It’s not easy to find people who share the same passion you do in business. It’s not easy employing people at all. But you will get there in the end, just don’t give up!

What advice would you give other business owners who are starting out?

Don’t give up! It’s not easy, things will go wrong, quite frequently! But if it was easy everyone would be doing it.

How did you start working with KC Accountancy Services, was there a reason they stood out from other accountants?

I started working with KC Accountancy Services when my local accountants were taken over by a big firm and seem to care less and less about smaller businesses like mine. Kim stood out as she gives you a personal touch and I like that she’s only a message away!

Why do you think it is important to work with an accountant, how has your relationship with KC Accountancy Services benefited your business?

I think our relationship with KC Accountancy Services has helped us grow. Everything is just simple and they are always doing things for my business behind the scenes that I don’t have to even think about any more. It enables me to just “go to work” and not think about the other stresses that come with running a business. Having that relationship is key to running a business successfully.

What are your future plans for Saxon Clean?

We’re going to keep giving the customers the best service we can continuously and plan to keep growing as we are. We’re looking forward to 2022.

Thank you Matt!

www.saxonclean.co.uk

Tel. 01691 649738

A few words from Kim…

“I have been working with Matt Saxon from Saxon Clean since 2018. He was at a point in the business where he wanted support and advice to allow him to effectively grow the business and increase profitability. Matt was unsure if his business model and structure was the best and most tax efficient for him, we jumped straight in and offered the advice and support he needed. Being in business as a sole trader, can be so daunting and overwhelming sometimes, you feel alone in decision making and can often question your instincts or abilities. Believe me, I know how this feels!

From the start, I pointed out to Matt, our services do not stop at compliance and producing his accounts and tax return. My aim is to try and be that support and offer a listening ear for him to run his ideas by, or even just a shoulder to help bear the load when he needed it most. The ethos behind KC Accountancy Services falls on a high level of customer service, I am passionate about it. Matt operates his business with a very similar ethos, and this has helped develop our working relationship with each other as we have a common understanding of each other and how we operate in business.

Matt has seen his business go from strength to strength over the years and navigated the transition to being VAT registered, which can be very difficult when many of your customers are individuals who are not VAT registered. Increasing your price by 20% suddenly, can be difficult to introduce, but Matt’s customer service helped him overcome this.

Matt has an ever-growing team of professional and loyal members of staff, we have supported and assisted Matt with employment contracts, holiday entitlement and various other HR tasks that come with being an employer.

During recent lockdowns, Matt has been lucky to continue working and his team have worked tirelessly to offer commercial cleaning and sanitising in the community. Matt even donated his time and materials at one point to sanitise areas of his local community, what a way of giving back!”

If you would like more information about our services, or if you are a current client and would like to be featured in a future edition of Client Focus, then please don’t hesitate to get in touch with our team:

info@kcaccountancyservices.co.uk

Tel: 01691 674792

To view the full interview in PDF, please click here.

My first ever job at 13 years old was as a shop assistant in a busy town centre fruit and veg shop, and it was here I first learned the mantra ‘the customer is always right’. We were expected to always ensure the customer left the shop feeling like they had received the best possible service and went home with everything they needed. If they felt they didn’t get that service, they would only have to say, and it would be rectified.

Now this was only 26 years ago (eek, showing my age), the mantra and respect behind it has remained with me to this day, but I think it would be fair to say it is slowly starting to die out and in fact, recent experiences tell me the customer is very rarely right anymore.

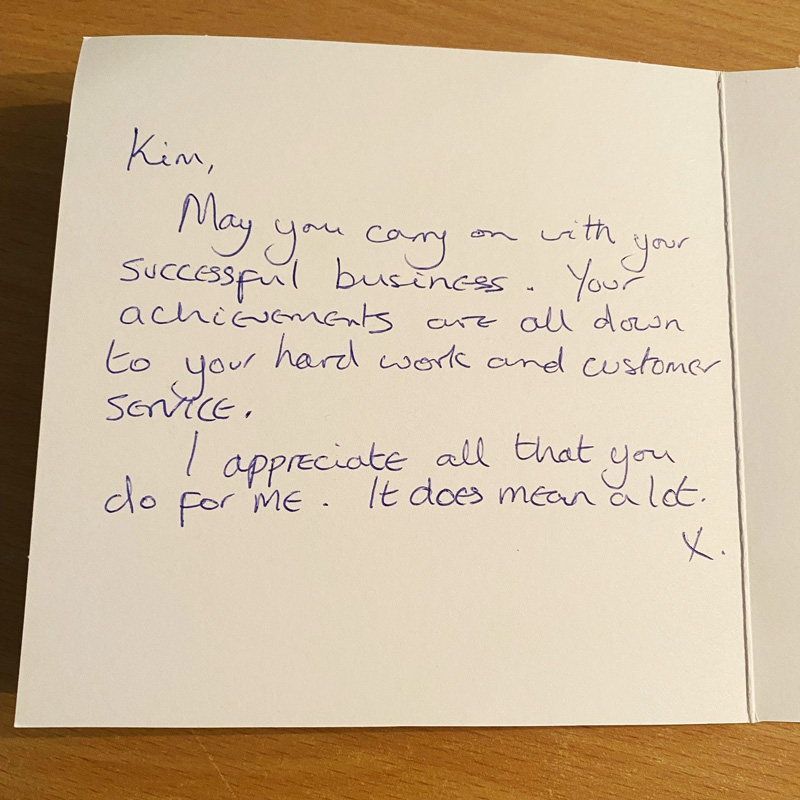

At KC Accountancy Services, customer service is at the heart of our business model and ethos, our customers are all VIP’s and without them, we wouldn’t be what we are. I was lucky to receive many Christmas cards from my clients in December, but one of them stood out with a heartfelt message included. It gave me a moment to breathe and be thankful that our customers are aware and feel the level of service we strive to provide.

I started to ponder, if as a generation we start to shift customer service from being the focus of our business and move success, growth, and wealth into its place, will it work? How long would it work for? Do I want those things to be my focus?

I kept coming back to the same stomach sinking feeling of, I didn’t like a world where the customer was no longer the focus and most important part of a business, so I re-read that message my customer had taken the time to write to me and reminded myself of why I set up the practice in the first place, in an industry seen as stuffy and archaic.

My first ever business goal was to offer the best possible service a customer could expect, to take the weight off their shoulders and to allow them to breathe. With the hope this support, and high level of service would give them the ability to offer the same to their customers and so it goes on. As the world turns, and generations change, one thing we will never change at KC Accountancy Services is our focus and that will always be our VIP customers and offering the best possible service we can.

In saying all the above though, I’m interested and intrigued to hear your thoughts as consumers and fellow business owners – is the customer always right, or is it time to move on from this? What is the focus of your business model?

We are embarking on a brand-new year, and let’s hope it’s better than the previous two. Whatever you feel the focus of a business should be, I hope 2022 is successful, less stressful and kinder than we have experienced recently.

This edition meet business franchisee and entrepreneur Becky who runs Toni and Guy hairdressing salon and The Beauty Lounge in the Shropshire market town of Oswestry. She tells us about her journey into hairdressing, expanding into a second beauty business eight years ago and how she has remained positive through the pandemic.

Becky has been a regional franchisee for Toni and Guy for the last 9 years. A year later, she opened The Beauty Lounge, a second business which she now runs alongside her hairdressing salon. We discover some of her successes and challenges and how working with KC Accountancy Services has enabled her to remain positive and plan for re-opening following the Lockdown.

Hi Becky! Please can you tell us what first inspired you to enter the hairdressing industry?

I’m a creative person and I love the fact of being able to change someone’s look and how they feel about themselves in an instant. Giving them confidence and helping them to feel good about themselves is amazing and so rewarding. Also, hairdressing to me is about making personal connections with your clients, helping them through life’s trials and celebrating life’s achievements.

If you had to describe your life to your clients in three words, what would they be?

Busy, happy, love

What has been your biggest success?

My biggest success has probably been winning Salon Retailer of the Year down in London. That was an amazing experience hearing them call out our regional Toni and Guy here in Oswestry amongst all the big city salons. There have been lots of memorable experiences in the salon that I’m proud of. I have an amazing, hard-working team and the biggest success really is watching them grow and developing their careers.

And is there anything that you have found challenging?

The most challenging time has definitely been with the whole COVID situation and having to deal with that, especially in the first lockdown. It was very stressful and worrying like it has been for everyone, but it’s definitely shown me how resilient and adaptable we all are.

At what point did it feel right to expand into the beauty business?

I had a lot of clients going elsewhere for their beauty treatment and I just thought why not bring everything under one roof to make it easier for them? Rather than them having to rush to another appointment, they can sit and relax and have it all done here.

How has working with KC Accountancy Services benefitted your business?

It so important to have an accountant that is honest, trustworthy, reliable and knowledgeable. You need be able to bounce your ideas off someone and for them to reign you in if needed or give you the push when maybe you’re not feeling at your most confident. Having someone there to reassure you that what you’re doing is correct and to help you develop and grow your business further in the right direction and that is exactly what I get from KC Accountancy Services.

What are your future plans and how do you see KC Accountancy Services supporting you to achieve your goals?

I have some big changes and plans coming up in the next 12 months and KC Accountancy Services will be guiding me through it all!

Thank you Becky!

The Beauty Lounge and Toni & Guy, Oswestry

TEL: 01691 653222

WEBSITE: www.toniandguy.com/salon/oswestry

A few words from Kim…

“I have known Becky for many years on a personal level and I was honoured when she approached me to assist with her new business venture of The Beauty Lounge, 8 years ago. The business has seen many changes since it was first launched, with changes to the structure and services developing and modifying over time.

Recently, we have also taken on the responsibility of producing the statutory accounts for Toni & Guy, Oswestry and have found this to be very beneficial when advising Becky regarding her personal tax situation.

Becky is very determined and ambitious, but with 2 businesses running alongside each other she is also very busy! Aside from ensuring she remains compliant with her responsibilities to HM Revenue & Customs and Companies House, we have also worked closely with her and the businesses to offer more day-to-day tasks like operating the monthly payroll and auto-enrolment pension scheme, bookkeeping and even some HR work. We firmly believe an accountant isn’t just for year end accounts, we can be involved and assist in so many other ways.

Covid-19 saw both The Beauty Lounge and Toni & Guy be severely affected, as with all personal services they were forced to close for long periods of time with so much uncertainty of their future. During this time, we assisted with securing funding through the Coronavirus Job Retention Scheme (CJRS) and local authority funding. In what was the most stressful point in business for Becky, she remained focused and positive, planning for the re-opening and making plans for the future.

Both businesses have bounced back from the pandemic and although slowly at first, they are now busy and thriving – I’d like to hope our support and assistance in gaining much needed funding during the lockdowns and enforced closures has played a part in the business still operating today.”

If you would like more information about our services, or if you are a current client and would like to be featured in a future edition of Client Focus, then please don’t hesitate to get in touch with our team:

info@kcaccountancyservices.co.uk

Tel: 01691 674792

To view the full interview in PDF, please click here.

In this action-packed edition of Client Focus, we welcome Adam & Mick Extance, owners of Mick Extance Off-Road Motorcycle Experience, one of the biggest off-road schools in the UK. Their training centre is set in the heart of the Berwyn Mountains in 1500 acres of private woodland.

Find out how business savvy and passion came together to help this father and son team turn their dream into reality.

KC Accountancy Services has been working with Mick & Adam from M A Extance Ltd. since 2017. When they first contacted us, they were going through a transition period. Adam was taking on more responsibility from his Dad, Mick, managing the day to day running of the business.

At the time they were also on the cusp of making large investments into the business. After many years of running their business from home with a remote office in Derby, they were about to move into a dedicated commercial building and become employers.

Kim recalls the worry both Adam and Mick were feeling regarding the responsibility of their employees and affording and maintaining a building. By supporting them, working closely together and offering financial forecasting, it has allowed this successful team to feel confident about their decision-making and see the impact this has on their finances and overall business performance.

Welcome Adam and Mick! In three words, can you describe your life as business owners?

Passionate, dedicated and very busy!

As entrepreneurs, what is it that motivates and drives you?

Giving our customers the best day out is the main motivation. Seeing people leave with a huge smile after a day’s riding makes it all worth-while and gives us the drive to always provide the best experience we can.

You’ve been trading now for about 12 years, what has been your biggest success and what have you found most challenging?

Our biggest success is turning a hobby into something that we love and that has grown into the success that it is today. Like most things, if you want to succeed you have to dedicate everything to it, so the most challenging part is making time for other things along the way.

We began working with you back in 2017. What was it about KC Accountancy Services that stood out from other accountants?

We have been friends for a long time, Kim has brought a lot of structure and support to our company she genuinely cares about the success of the company and that makes a huge difference

Why do you think it is important to work with an accountant, how has your relationship with KC Accountancy Services benefitted your business?

It is one of the biggest parts of running a business. To know the company figures and statistics is what enables growth or cuts. Without understanding that, it’s hard to progress and that is the most valuable thing KC Accountancy helped us with.

Can you tell us what advice you might give other entrepreneurs who are starting out?

Understand the business you are wanting to do, and have a passion for it.

Finally, what are your future plans and how you see KC Accountancy Services supporting you to achieve your goals?

Our plans are to provide one of the best experience days in the UK, we work close with KC accountancy to make sure everything is structured and running smooth.

Thank you Adam and Mick!

MICK EXTANCE OFF-ROAD MOTORCYCLE EXPERIENCE

TEL: 01332 347592

EMAIL: info@mickextanceexperience.com

WEBSITE: www.mickextanceexperience.com

A few words from Kim…

“Adam and Mick are very passionate about their business, over the time we have worked together Adam has shown a keen interest in the financial figures, what they mean and the implications of them in the annual accounts. I have spent a lot of time going through our accounting practices with Adam, showing our workings and how we have calculated the figures. I believe firmly in encouraging business owners to be heavily involved in the preparation of annual accounts and to have a good understanding of the figures and how they are calculated. This knowledge allows clients to understand the impact of business decisions on the profit margin and ultimately the tax bill!

As a practice, I want to offer a completely honest and transparent service, where clients feel comfortable to question our work to gain a better understanding of their business. Our role is not to just prepare a set of annual accounts, we are there to use those accounts to help you make the best possible decisions for you and your business, to encourage more involvement from you in their preparation and imparting knowledge regarding accounting adjustments and policies. After all, like they say, knowledge is power!

Our close working relationship has continued with Adam and Mick. Prior to making any kind of change or investment in the business, they will contact us to assist and support them with a final decision. We want all our clients to succeed and prosper as much as they do.

There are some exciting times ahead for M A Extance Ltd and we wish them every success, with continued support in the background!”

If you would like more information about our services, or if you are a current client and would like to be featured in a future edition of Client Focus, then please don’t hesitate to get in touch with our team:

info@kcaccountancyservices.co.uk

Tel: 01691 674792

To view the full interview in PDF, please click here.

Welcome to our first edition of Client Focus. We are very pleased to introduce Mark Martin, owner of M. Martin Forestry, a forestry contractor working across North & Mid Wales, and Shropshire.

In this interview, we find out how working together has benefitted his business and, as well as being a loyal customer, Mark and his family have become good friends.

Mark Martin, our very first customer, approached us back in 2009 looking for some business support. At the time, KC Accountancy Services was still in its infancy and business owner Kim Cleminson-Jones was operating a small bookkeeping practice. She was able to help Mark prepare his accounts for his then Accountant, as well as provide general finance and administrative support.

In 2016, after qualifying as a Licensed Accountant and becoming a full member of AAT, Kim extended the portfolio of services at KC Accountancy. As the practice began to grow, so did the range of services and Mark approached us again, this time to take on the full scope of his business accountancy needs. We now provide an all-round business and finance package to support his business.

Hello Mark! To start off with, in three words, can you describe your life as a business owner?

Best move ever!

Mark, you began working in the forestry industry at a young age. As an entrepreneur, what is it that motivates and drives you?

What motivates me each day is trying to do the best job I can for each and every client.

In business, what has been your biggest success and what have you found most challenging?

My biggest success has been keeping clients happy and also at times, this is the thing that has been most challenging!

How did you start working with KC Accountancy Services, was there a reason they stood out from other accountants?

If I’m honest, I’m not very good with paperwork and Kim quite literally came to save me, helping to organise my bookkeeping and prepare my accounts. KC Accountancy is always there when I need them and that is a massive help in business.

Over the years we have worked together, the forestry industry has undergone many changes, specifically in recent years regarding regulations around sustainability and the environment. Can you tell us what advice you might give other entrepreneurs who are starting out?

Apart from having experts on hand to call on for advice when you need, particularly as regulations change, what I think it’s really important advice to remember is not to take on more than you can handle because you will just let people down.

Finally, what are your future plans and how you see KC Accountancy Services supporting you to achieve your goals?

My long-term goals are to build up a business up for my children. I’m sure KC Accountancy will be an important part of this journey and I’ve no doubt that they will be there to help me on the way.

Thank you, Mark!

MARK MARTIN

MARTIN FORESTRY & FENCING

TEL: 07855 974352

A few words from Kim…

“I have supported Mark through some excellent highs in his business and some of the most stressful times. I am proud to call Mark and his family friends as well as loyal clients; this working relationship is exactly the ethos behind KC Accountancy Services. I value every single client I am lucky enough to work with and support. They are so much more than clients in as much as I have been honoured to be a part of some of their most important life events.

Being invited to attend Mark’s wedding and watching him and his lovely wife, Saran grow their family to 4, following the birth of their boys, Llion & Gwil has been such a privilege. I am so grateful for their support and loyalty in return over the years.”

At KC Accountancy, we pride ourselves on our friendly, personable service. We get to know both the business and the individual involved, so we can really tailor our services to meet the needs of your business.

If you would like more information about our services, or if you are a current client and would like to be featured in a future edition of Client Focus, then please don’t hesitate to get in touch with our team:

info@kcaccountancyservices.co.uk

Tel: 01691 674792

To view the full interview in PDF, please click here.

[testimonial author]

Rated 5.0 on Quickbooks ProAdvistor

800+ Likes on Facebook

Ready to feel more in control of your finances?

Book a free, no-obligation discovery call today and find out how we can help.

Tel. 01691 674792

Email. info@kcaccountancyservices.co.uk